How to make the most of your student life without going bankrupt!

Let's be honest, being a student really puts a big hole into your wallet. This as an addition to studying, maintaining a social life, doing all the mundane household chores, and maybe even working, can sometimes seem like a bad horror movie.

Luckily, I compiled the best advice, so that the next time you check your bank account it does not feel like a small heart attack.

First off: simple organisation:

It is so easy to lose track of your finances, especially with multiple apps, cards, and money being deducted from your account at different times of the month.

To organise this, it is highly advisable to make a clear overview first.

Monthly income: Job, assistance from family members, grants, scholarships, etc.

Fixed expenses: Rent, phone bill, subscriptions

Variable expenses: Food, transportation, splurging on new clothes, going out, a day trip

You can track this for a month, to get a good estimate of what your monthly spendings are. There are many apps for this like Mint, YNAB, or if you just want to go old school, a simple Excel sheet or piece of paperwork just as well.

Through this you can get a nice overview, and see where your money goes into, and maybe even consider that a 5 euro latte every day, does empty your bank account quite fast.

Determine needs vs. wants:

Unfortunately, budgeting means prioritising, and saying no to a poke bowl in the cafeteria every once in a while is part of it.

Our tip: Use the 24h rule for impulse buy, if the item you want to buy still has relevance to you in 24 hours it's way more justifiable to buy it. (aka the vintage T-shirt, or the vanilla scented candle)

Meal prepping and farmers' markets are your new heroes:

Preparing your meal in advance can save you loads of money and time:

-

Buy your non-perishable food in bulk (pasta, rice).

-

Use farmers' markets for fresh fruits and veggies (often much cheaper than you might think).

-

Carrying your lunch with you and warming it up in one of the university’s microwaves will save you loads of money.

Not only will you save money with this, but it is also amazing not having to cook every day: especially in exam phases. So meal prepping isn't just for gym bros, but it is a nice way to save some extra money.

Use your student discounts for good:

You would be surprised by how many places offer student discounts. Not only can you get into museums much cheaper or sometimes even for free, but cinemas and many other venues will also offer you discounted prices. So do not be too shy to ask for a discount!

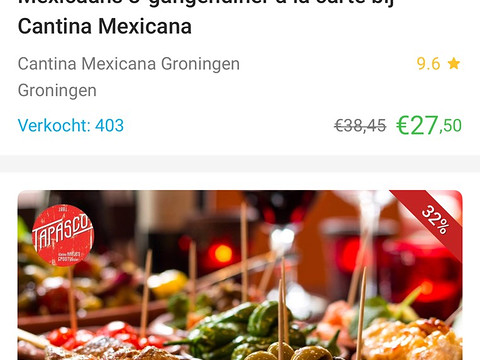

Also apps like UNiDAYS, Social Deal or Student Beans will offer discounts to many stores, and most of the music and TV subscription services offer hefty student discounts too.

Build your emergency fund

Saving money while you're broke? Does not seem to make a lot of sense at first, right?

But hear us out: putting away even 10–20 euro a month into a separate bank account or wallet labelled “Do not touch unless doomed” can come in handy at times when your laptop screen cracks during exam season, or you need to buy a textbook all of a sudden.

Work smarter, not harder

Of course, your study takes up a lot of your time, but a little side gig here and there can really help you spruce your budget up, so you finally can splurge on your latte.

In Groningen there are many options, that won't take up too much of your time:

-

tutoring

-

selling old clothing/books

-

taking online surveys (low effort, and low reward, but every penny counts!)

Just don't burn out while also being in your exam phase, because your grades always matter.

Yes, unfortunately budgeting is a bit annoying at first, but as soon as it becomes a habit, you will feel less stressed.

Of course, somehow, being broke as a student is almost a rite of passage, but if you budget correctly, your wallet and your future self will thank you.

Author's info

-

Greta Dudley

My name is Greta, I am 20 years old, and a second year Physiotherapy student at Hanze. I am originally from America and Germany, and enjoy writing short stories or articles, and since this isn't a really prominent part in my study, I love writing articles for our student blog here! Besides this I love travelling and working out, and spending time with my friends!

Feedback component

How satisfied are you with the information on this page?